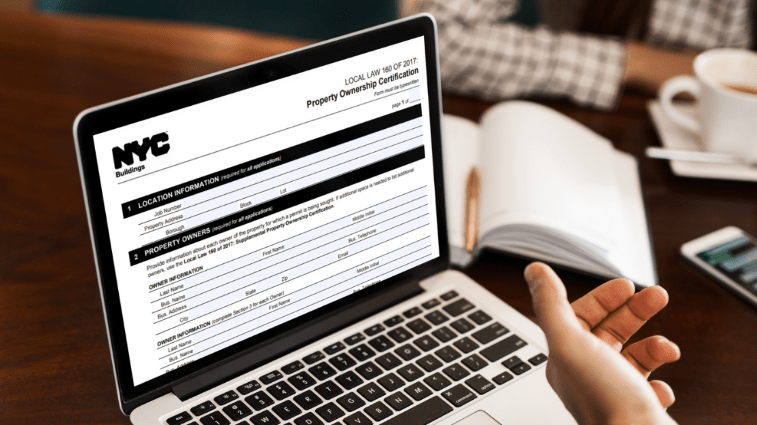

A New Hurdle for Building Owners: Property Ownership Certification Form

Originally set to begin on June 30, 2021, DOB NOW permit applications will need an extra form in order to get approved. A DOB service notice released on June 28, 2021 revealed that enforcement will begin in August of 2021 with the official launch date and additional details to be announced.

The Property Ownership Certification form is an un-waivable form for all permits (except Limited Alteration Applications (LAA), electrical, elevator jobs, and jobs for government-owned properties) that will check whether the property owners involved owe a certain amount of covered arrears to the City of New York before approving the property for a permit. The recent postponement announcement also removes this requirement for non-NB and ALT1/CO projects for the interim.

Covered arrears are defined as:

- “Unpaid fines, civil penalties, or judgments entered by a court or by OATH pursuant to Chapter 2 of Title 28 of the NYC Administrative Code; and

- “Unpaid and past due fees or other charges assessed by DOB.”

This follows up an earlier update (effective March 1, 2021) that under Local Law 160 of 2017, the DOB has the right to deny new permits for projects whose owners owe $25,000 or more, as well as the right to revoke active permits.

This $25,000 limit doesn’t have to apply to any one property or any one owner – as long as the total sum of covered arrears not currently in the appeals process exceeds $25K, any new permits for the project will be denied.

In addition, if you as an owner owe more than $25K, you may not be able to get a permit for any buildings you own until your debts are paid.

How to File

At the time of the March update, applicants were only required to check a box on the PW1 form stating whether or not the owners’ unpaid arrears surpassed the limit.

This new form appears to replace, or at least augment, that statement, but is still attached to the PW1, as the form must be submitted through the Documents tag on the Plan/Work application on DOB NOW: Build after plans are approved, prior to permit issuance.

Under LL160 of 2017, applicants must provide on the Property Ownership Certification form:

- The name and business address of each owner of the property

- A list of the properties in New York City owned by each owner; and

- Whether each owner owes covered arrears to the City for each property and the amount of the covered arrears owed.

If you have more than four owners and/or more than 35 properties to list, there is a Supplemental Property Ownership Certification form available to add on. In that case, you must upload the original and supplemental forms as one file under “Property Ownership Certification form”.

At this time, we at Outsource think that owners may be able to utilize the same form for each permit request, but the form will need to be updated as new violation penalties are received. This may change once enforcement begins in August of 2021.

Exceptions

While the best way to avoid complications is to keep your covered arrear amounts under control, there are exceptions to keep in mind that may help move the process along if your project hits a snag under this rule.

For one, the applicant can submit a certification from the Department of Finance stating that binding agreements are in place that require payment of all covered arrears owed by the property owners, and that the owners are in compliance with this agreement.

In addition, special conditions may allow the permit to go ahead in spite of the covered arrears, such as when the permit is:

- Needed to correct an outstanding code violation that the commissioner deems necessary for public health and safety, or requested for a property that is the subject of a court order brought about by the Department of Housing Preservation and Development.

- Designated for a portion of a property occupied by a tenant who is not responsible for the covered arrears with respect to the property.

- Meant for a dwelling unit within a property owned by a condo or held by a shareholder of a cooperative corporation under a proprietary lease, where the owners of the unit do not owe a collective $25,000 or more in covered arrears to the city.

- Requested for a loan or for program participation through the DHP or the New York City Housing Development Corporation that involves rehabilitation of the property, as deemed by.

(For full list of exceptions, see Local Law 160.)

Applicants should be able to note whether an exception applies to the project in question on the PW1.

While it’s too early to tell exactly how this new requirement will be enforced, it is clear that LL160/17 and the Property Ownership Certification form will present major hurdles for building owners going forward.

For assistance navigating the application process and resolving violations, or for any other code concerns, Outsource Consultants is here to help.

Resources

- Service Notice (May 27, 2021)

- Service Notice (March 5, 2021)

- Local Law 160 of 2017

- Service Notice (June 28, 2021)